The FRAGG Invest Green and Impact Fund is a special limited partnership (SCSp/SLP) based in Luxembourg. It is managed by FRAGG-Invest GP

Sarl Luxembourg, advised by FRAGG-Invest GmbH Germany, and administered by CREATRUST Sarl Luxembourg. The fund aims to achieve

balanced long-term social, environmental, and financial returns, aligning its investments with the Sustainable Development Goals (SDGs) in areas like

climate preservation, gender equality, and reducing social and economic exclusion.

The investment strategy focuses on sectors such as inclusive finance/fintech, healthcare/health-tech, agriculture/agtech, climate finance/circular

economy, education/edtech, and affordable housing/prop-tech. It targets emerging and frontier markets, particularly in Sub-Saharan Africa, Europe,

and Latin America.

The fund offers various investment instruments, including debt (subordinated debt, venture debt) and equity, aimed at early-stage, high-growth, and

expansion-stage companies. Key features include investment sizes ranging from $250,000 to $5,000,000, a closed-ended structure with a lifespan

of 10 years plus an additional 2 years, and USD as the base currency. The fund aims to achieve a final closing of 100 million USD.

The fund prioritizes support for women and youth-owned or managed businesses, adhering to ESG policies, promoting organic growth with strong

performance, and ensuring investment diversification to mitigate risks. It emphasizes inclusiveness by targeting services for the bottom of the

pyramid, impact through businesses with a track record of impactful investments and robust financial sustainability models, and compliance with all

statutory and regulatory requirements.

At FRAGG-INVEST GP Sàrl, we hold our Inclusive Financial Institutions pipeline to the highest standards, making sure that each potential target aligns with our working criteria. Our targets must embody characteristics of accessibility, sustainability, and positive societal impact. With a steadfast dedication to excellence, we aim to cultivate a portfolio of institutions that not only thrive financially but also promote economic empowerment and social well-being.

Institutions must have a verifiable history of measurable, scalable positive social impact, a vision for continued positive impacts, and strong financial sustainability models.

Comply with all statutory regulatory provisions in the area of operation and have at least 3 years audited financial statements.

They must possess an Impact portfolio asset size of at least 2 Million USD.

A strong governance structure and management team.

At FRAGG-INVEST GP Sàrl, we hold our SME pipeline to exacting standards, ensuring each potential investment aligns with our proven criteria. Our targets must embody qualities of innovation, sustainability, and growth potential. We meticulously assess each opportunity, seeking ventures poised to make a significant impact in their respective industries. The following criteria must be met to be a target:

Need significant investment with a high capital cap.

Have operating outreaches covering both rural and urban areas.

A financially viable business model.

Focused on an organic growth approach.

Have a diverse staff with reasonable number of women and youths, with projects that support women and youths in ownership and outreaches.

Clear and transparent ownership structure and a strong management team in place.

At FRAGG Invest - Sàrl, we target key regions where we see the greatest potential for growth and impact. Through careful analysis, we identify promising markets and opportunities for investment. By concentrating our efforts in these areas, we aim to drive economic development and create lasting value for both investors and local communities.

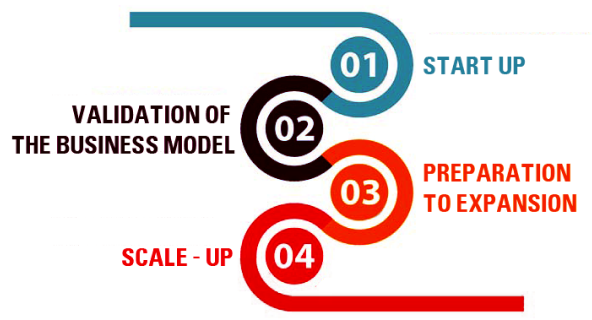

Our investments focus primarily on expansion-stage companies. However, we are able to consider investment opportunities in all growth

phases of the impact focal companies.

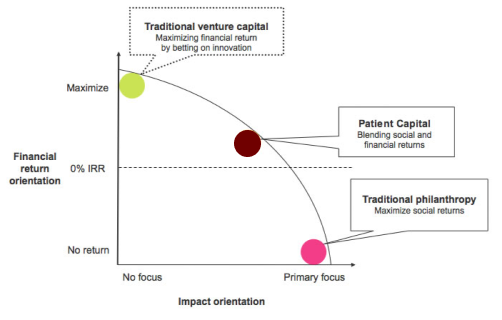

We offer patient capital to high-impact/high-growth companies. However, we also value the commercial returns to investors, as this is key to

ensure the long-term sustainability of our initiative. Hence, we balance the interests of the investors with the price to pipeline beneficiaries.

FRAGG-INVEST GP Sàrl's proven track record speaks for itself, leading to a legacy of unparalleled success. Our journey is defined by innovation,

strategic vision, and unwavering dedication. Join us as we continue to shape the future of finance with integrity and expertise.

FRAGG managed a 25 Million USD Debt Fund with 99.8% recovery rate and 10% ROI to investors.

FRAGG has over 100 years combined experience in SME Fund Management, Fund Mobilisation, and implementation of Business Development Services for SMEs and Impact Project.

FRAGG has an understanding of the local trends in monetary policies, hence FX risk advice is tailored to fully protect investees.

FRAGG has a high network in the Impact Investment ecosystem covering the investors, local financial institutions, regulatory bodies and good pipelines.

FRAGG has an experienced local team, with deep knowledge of the local market, culture, language, socio-political and regulatory environment in the West African region, while maintaining a strong external affiliation with international stakeholders in the impact ecosystem.

Trust FRAGG to put your capital and interests first