The FRAGG Impact Fund is driven by the need to promote sustainable and impact finance and to provide financial resources and technical assistance to viable multi-sector SMEs in West Africa.

Even with the availability of several institutions and services for financing small businesses, access to finance remains a major challenge to the growth of Small and Medium Scale Enterprises in the focal region. It is estimated that the region faces over $60 Billion funding gap for SMEs annually.

FRAGG Impact Fund is a 75 Million USD closed-end fund to be domiciled in Mauritius, to invest in growth/expansion stage companies with ticket size ranging from 500,000 USD to 6,000,000 USD. Our goal is to fill a market gap in the West African market.

The fund which is currently being structured aims to provide businesses in West Africa long term risk capital that allows them room to operate at their full potential. As an SME-focused fund, FRAGG’s main target is investing in high-growth companies in West Africa, especially those at the expansion. Our goal is to make a strong financial return for our investors while supporting companies that are contributing to a better world.

SMEsOur SME pipeline targets must meet with the following characteristics:

Inclusive Financial InstitutionsPipelines with the following characteristics:

Our Geographic Focus Covers

- Nigeria

- Benin Republic

- Togo

- Ghana

- Cote d’Ivoire

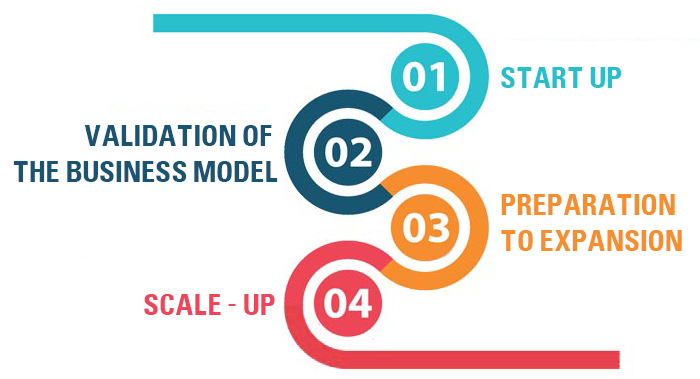

Our Growth Lifecycle

Our investments focus primarily on expansion-stage companies. However, we are able to consider investment opportunities in all growth phases of the impact focal companies.

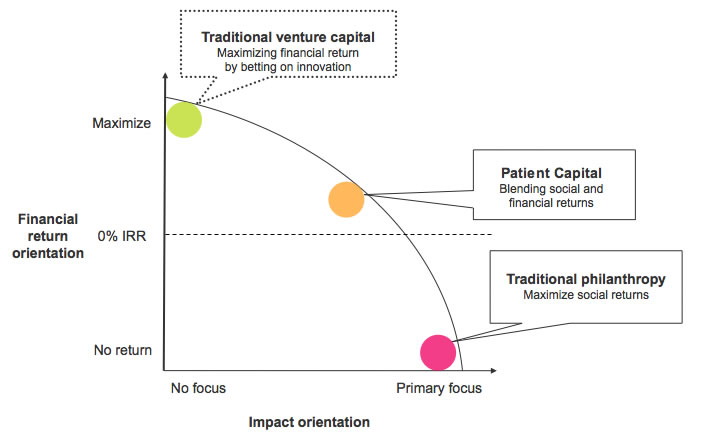

We offer patient capital

To high-impact/high-growth companies. However, we also value the commercial returns to investors, as this is key to ensure the long-term sustainability of our initiative. Hence, we balance the interests of the investors with the price to pipeline beneficiaries.

Team Track Record

$25M

Managed a 25 Million USD Debt Fund with 99.8% recovery rate and 10% ROI to investors

100

years

Has over 100 years combined experience in SME Fund Management, Fund Mobilisation, and implementation of Business Development Services for SMEs and Impact Project

Trends

Has an understanding of the local trends in monetary policies, hence FX risk advice is tailored to fully protect investees

Network

Has a high network in the Impact Investment ecosystem covering the investors, local financial institutions, regulatory bodies and good pipelines

Skilled

An experienced local team, with deep knowledge of the local market, culture, language, socio-political and regulatory environment in the West African region, while maintaining a strong external affiliation with international stakeholders in the impact ecosystem